EL-AL stands as the largest airline in Israel, possessing the highest market share among the airlines operating at Ben-Gurion Airport in Tel Aviv. Nevertheless, this position has not exempted the airline from difficulties in achieving profitability over the last decade. It has encountered various obstacles, including fierce competition from low-cost airlines, a strong labor union, and the overall volatility of the airline industry, which is affected by changes in foreign exchange rates and fuel prices. Coupled with the geopolitical challenges faced by Israel, this situation marks the company as a highly speculative investment.

Covid

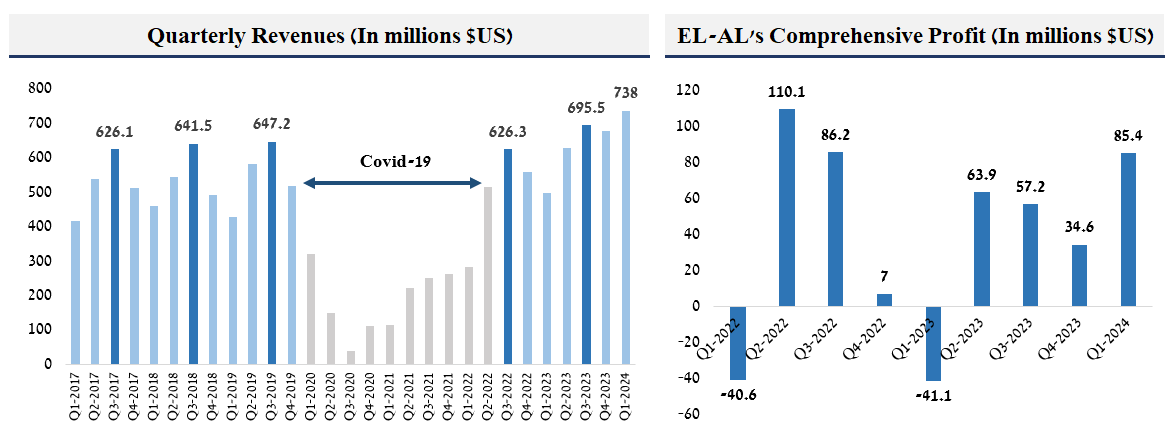

Throughout the Covid-19 pandemic, EL-AL experienced a financial loss nearing one billion dollars over a span of two years. Despite this, the company managed to sustain its operations through financial assistance from the government and private investors. Moreover, EL-AL utilized this period to optimize its operational efficiency by making a reduction of 21% in its workforce, from 6,303 employees in 2019 to 4,980 employees in 2023.

The war impact

A few days after the war broke out in Israel on October 7, 2023, the company announced its expectation of a significant drop in flight demand, predicting a negative impact on its financial results. However, to the surprise of both the market and EL-AL’s management, the company reported an increase in profits.

A temporary monopoly

As foreign airlines worldwide began to suspend their flights to Israel, EL-AL found itself among the few airlines still providing international travel options. This development resulted in EL-AL’s market share rising to over 63% in the first quarter of 2024. During this phase, the airline enjoyed the benefits of pricing power that monopolies often possess, allowing them to charge higher prices for flight tickets for several months. This abnormal situation benefited EL-AL’s bottom line.

After some time, these airlines started to reinstate their flights to Israel, leading to a decrease in ticket prices. However, this was yet to be the end of EL-AL’s good fortune. In July 2024, Israel executed two targeted assassinations of high-profile leaders from Hamas and Hezbollah, sending shock waves throughout the world. With Iran and Hezbollah promising a harsh retaliation, the fear of a regional conflict has led almost all major airlines to suspend flights to Israel once again.

Even before the war, EL-AL’s operational efficiency was evident, as they were able to achieve profitability in the three latest quarters of 2023. Following the latest flight cancellations, EL-AL is anticipated to continue its dominance in Israel’s airspace and reap profits after years of hardship. The third quarter is typically the peak travel period for families seeking international destinations, thus the potential escalation with Iran and Hezbollah presents a timely opportunity for the airline to preserve its temporary monopoly in the airspace and achieve record profitability.

A shrewd investment or a trap?

Year-to-date, EL-AL’s stock has risen by 60%. Tomorrow, the company will announce its financial results for the second quarter. Observing the stock’s performance in the upcoming months will be quite interesting. Currently, it seems that everything is falling into place for EL-AL.