Executive Summary

The Tel Aviv Stock Exchange is the only stock exchange in Israel, giving it a unique position in the competitive landscape in terms of pricing power and long-term survivability. Israel’s economy was growing at a 7.2% CAGR between 2009 and 2022. With Israel being the nation with the highest fertility rate among OECD countries, the fast growth of the Israeli economy is expected to continue in the years ahead as well. Positive catalysts such as the possible passing of a bill to reduce capital gain tax in Israel could drive long-term demand for Israeli securities. With a current market cap of 2.8 billion NIS and P/E ratio of 33.5, we view the current price as a reasonable entry point (share price of ~30 NIS), and a price of 27 NIS and below as a good entry point as a long-term investment.

About the Tel Aviv Stock Exchange

Established in 1953 and publicly listed since 2019, The Tel Aviv Stock Exchange (“TASE“, or “Exchange“) serves as the primary platform for trading financial securities in Israel. TASE plays a crucial role in facilitating the exchange of financial securities and enabling corporations and the Israeli government to raise capital and debt. Prior to its initial public offering, the exchange experienced a transition in ownership structure in 2017 – shifting from a non-profit organization owned by Israeli banks and investment firms, to a for-profit entity controlled by private and institutional investors.

Products & Services

TASE’s service offerings are spread into 4 categories:

- Trading and clearing

- Clearing house services

- Listing fees & levies

- Data distribution and connectivity services

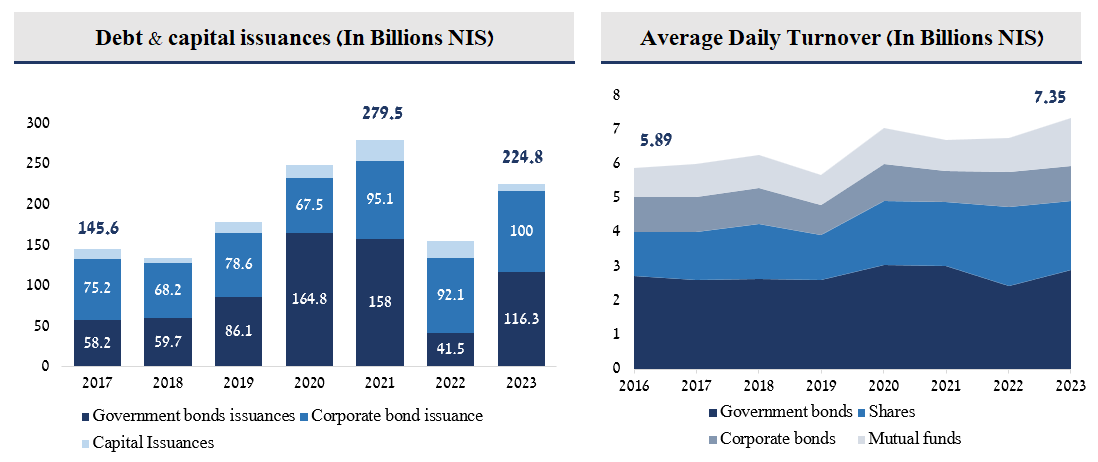

Essentially, TASE profits from increased trading volume, higher total market capitalization of financial instruments, a greater number of public companies and bonds listed, and by offering unique data for research. As of March 31, 2024, there are 535 listed companies (shares and bonds) with a market capitalization of 1.155 Trillion NIS (~$308 billion US).

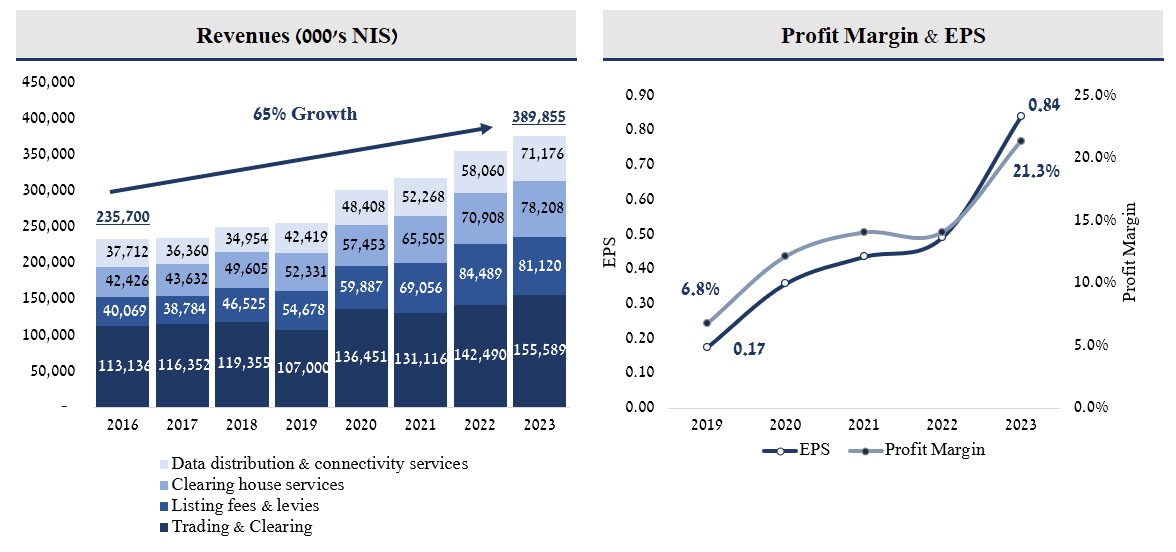

Financial Performance

TASE has experienced a 65% increase in revenues over the last 7 years, with earnings per share climbing from 0.17 in 2019 to 0.84 in 2023, marking a nearly 400% rise in just 4 years. The profit margin also saw a significant improvement, rising from 6.8% in 2019 to 21.3% in 2023, showcasing TASE’s strong pricing power and operating leverage. The growth in revenue can be attributed to the increased activity in the exchange and the expansion of the Israeli economy, as well as some revenues being tied to the CPI.

Competition

TASE faces competition from international exchanges, particularly the American market, as many major Israeli high-tech companies favor issuing shares overseas. Private equity funds, banks, and other financial institutions also compete by providing loans to companies and executing OTC hedging transactions using options and futures. Additionally, there are four trading platforms in Israel where traders can engage in forex, derivatives, and crypto trading. Currently, TASE holds a unique position as the sole institution allowing multilateral trading in Israel, providing it with a robust competitive advantage in terms of its ability to raise prices and due to the lack of local exchanges.

Future Growth Prospects

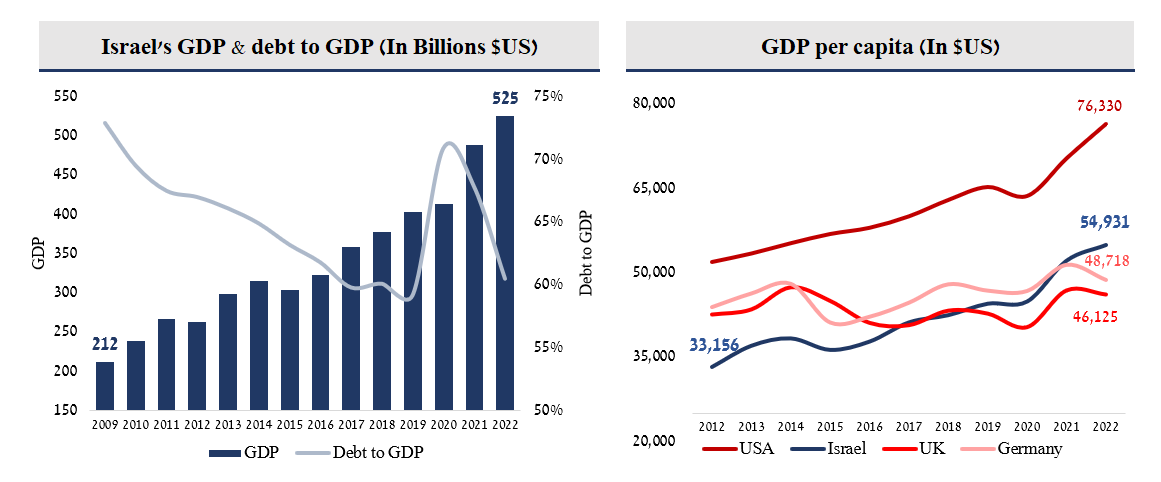

The Israeli economy experienced a robust growth rate of 7.2% CAGR from 2009 to 2022, with GDP per capita rising from $33,000 in 2012 to approximately $55,000 in 2022, surpassing both Germany and the UK at around $48,700 and $46,100, respectively. In 2022, Israel’s debt to GDP ratio was approximately 60%, significantly lower than the US at around 115%. Despite the ongoing conflict in the Middle-east, Israel’s central bank projected in July 2024 that the debt to GDP ratio would increase to 67.5% in 2024 and 68% in 2025 – still within a healthy range.

The TASE, as Israel’s principal stock exchange, is set to experience direct advantages from the country’s economic progress. It is expected that the key driving force behind Israel’s rapid economic growth will be its continuously expanding population. According to the most recent data from 2021, Israel’s fertility rate stands at 3.00, indicating an average of three children per woman, in contrast to the OECD average of 1.58.

Additional factors that will drive the future growth of TASE include the surge in popularity of trading in the financial markets that began in 2020. As of December of 2023, it is estimated that Israelis hold around 1 million brokerage accounts, but most of them do not directly participate in the Israeli stock market. Furthermore, in early 2024, members of the Israeli Knesset introduced a bill to decrease the capital gains tax from 25% to 20%. If the bill is approved, it will lead to a greater demand for financial securities in the public Israeli market, resulting in increased trading activities and higher valuations, ultimately boosting TASE’s revenues.

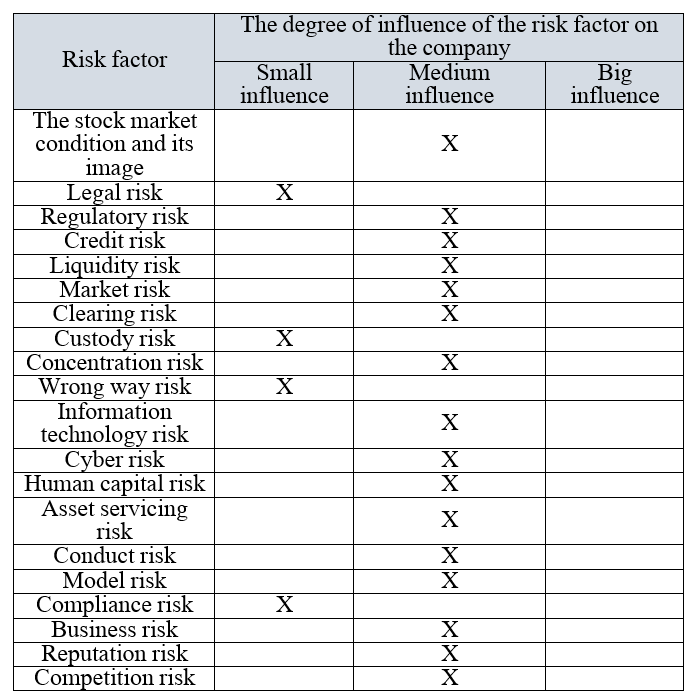

Risks

Recent Developments

- On the 18th of July, TASE announced a price increase of its custody services. The price increase is expected to generate additional 11 million NIS in revenues in 2025, 26 million NIS in 2026 and 44 million NIS in 2027 and onwards.

Valuation & Conclusion

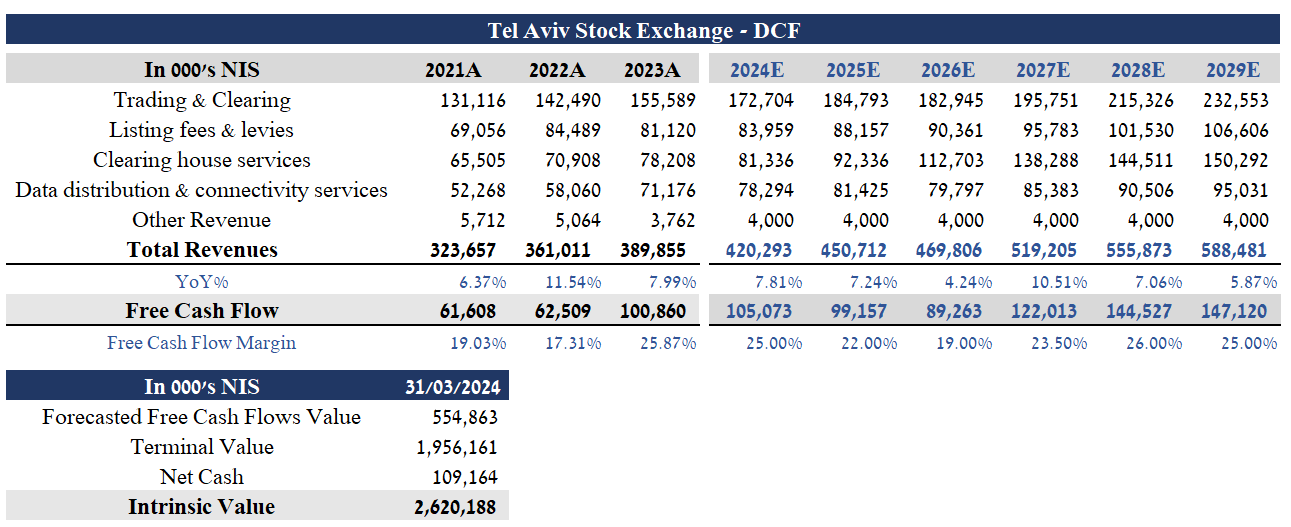

Our valuation assumptions include a 8% discount rate and a 3% terminal growth rate.

As of 30th July 2024, TASE trades at a market capitalization of 2.8 billion NIS and Price to earnings ratio [P/E] of 33.5. According to our estimation, TASE currently trades at fair value. Although the current valuation seems grievously expensive, our view is that TASE’s valuation will remain “expensive” in the years to come given its competitive position. The current market price is not a bargain, but considering TASE’s ability to raise prices and the favorable long-term tailwinds [fast growing population and the possible reduction of capital gains tax], we view the current price [~30 NIS per share] as a reasonable entry point, and a share price below 27 NIS as a good entry point.