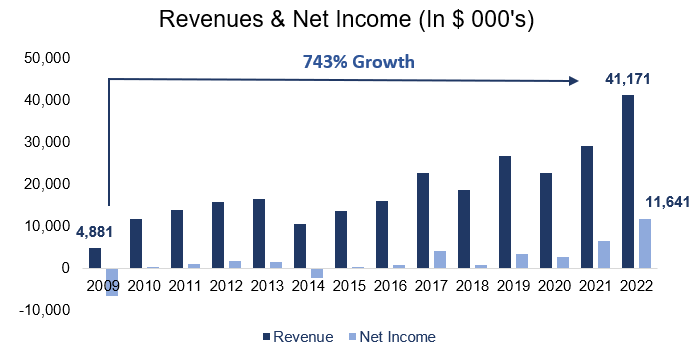

QualiTau is the leading manufacturer of reliability test equipment in the global semiconductor industry.

QualiTau provides comprehensive solutions for testing and characterizing certain physical phenomena that cause a decrease in the reliability of integrated circuits.

Their products are essential for the semiconductor industry

Every semiconductor fab as part of their manufacture process, need to make sure that the chips that they manufacture are working properly under certain conditions.

Some chips may not work properly, and QualiTau’s equipment helps those companies to filter out the chips that are not reliable and prevent them from reaching to the final customer.

Furthermore, they offer testing services in their US facility for customers who are at need of ad-hoc services or those who consider purchasing their equipment.

QualiTau serves almost all of the semiconductor manufacturers in the world.

I think it’s astonishing how a small company like QualiTau, with merely 66 employees as of 2022, are such an important company in the global semiconductor industry. Some of QualiTau’s customers include AMD, IBM, Micron, Intel, TSMC, Sony, SK-hynix, Qualcomm and more.

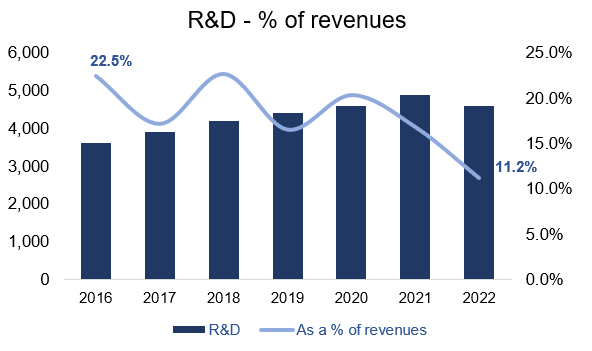

R&D – Testing the future

Research and development in the field is of vital importance to the success of the company. Fortunately, QualiTau invests high sums of money into R&D and the results are evident.

Recently, QualiTau announced that they developed a new product as per request by a large chip manufacturer in the US. The company estimates that the new product will be a new and strong growth engine in the years ahead.

As part of the chip war between the US and China, both nations are planning to expand their investments in semiconductors heavily. This is yet another positive catalyst for revenue growth in the near and distant future.

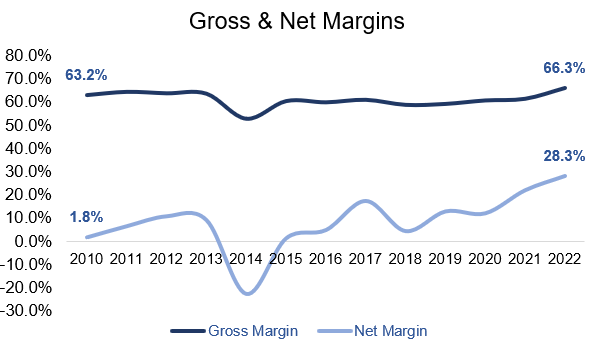

Below are some of the financial metrics:

Competition

QualiTau operates in a small niche within the semiconductor industry with only a few competitors. According to the management, most of their competitors are only operating in certain geographies in Asia and offer products with limited functionalities. The management mentioned that a competitor from Asia, quote: “has no respect for intellectual property”, and is copycatting QualiTau’s products. Undeniably, that is both a negative and a positive sign, because if a company’s products are being copycatted, it means that they are the leader in the field.

In contrast to the competition, QualiTau is operating globally and offers turn-key products and services. The supremacy of their products is proved by the customers’ choice, as almost all chip manufacturers around the world prefer to use their products. It is important to mention that although QualiTau are currently the first choice in the industry, there isn’t a strong moat around their business and at any given moment they could lose market share if a competitor will develop a better product.

Risks

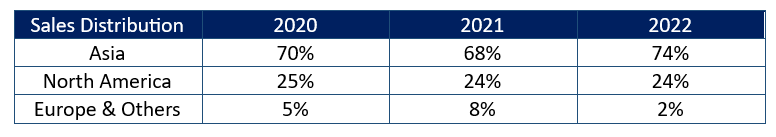

The word that comes to mind when thinking about the risks associated with QualiTau’s business is “uncertainty“. The US and China are in the midst of a chip war, and the US is trying really hard to prevent China to put their hands on US technology, as well as to slow down their technological advancement in the field. As collateral damage, QualiTau lost some sales as the deliveries of their products were banned from reaching certain Chinese companies.

Other major risks include a potential war in Asia, particularly between China and Taiwan, as well as in South Korea and Japan. If a war will breakout in the area, that would affect the financial results of QualiTau negatively. Additionally, losing market share to competitors is yet another risk, especially to customers in Asia.

Human Capital

In 2021-2022, the 5 most senior executives at QualiTau received over $2.5 million in salaries and bonuses each year, which is equivalent to 8.7% and 6.1% of revenues, respectively. Currently, this is a no man’s business as there isn’t any large shareholder which steers the ship. An Israeli hedge fund and an investment house currently hold ~29% of the shares. The CEO has 28 years of experience in the semiconductor industry, particularly in sales, marketing and management. At last, In the event of his dismissal or resignation, the minimal prior notice period is 9 months. He himself own a minor stake in the company (0.23%).

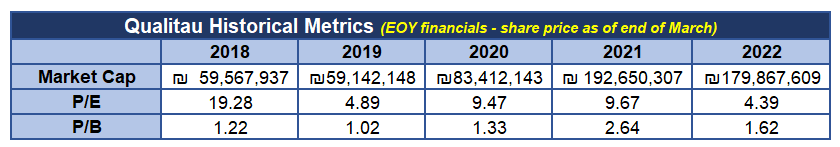

With all that being said, how much QualiTau is worth?

In recent years, the company was trading between 1x – 2.5x of book value. Currently, they trade at ~2.15 book value. A consistent gross margin indicates an ability to raise prices at the rate of inflation.

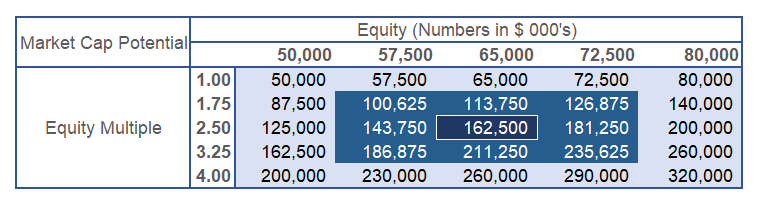

Overall, my belief is that the opportunity for returns in the stock price lies within the expansion of their multiples. on the positive side of the business cycle QualiTau could potentially be trading at up to 4 times book value.

Below is a sensitivity table summarizing the potential returns for the company for the next 10 years:

As of the 18th of October 2023, QualiTau’s valuation metrics are:

- Market Cap – 280M NIS

- Equity – $33.5M

- P/B – ~2.15

To conclude

The potential returns for the next 10 years from today’s market cap could range between 26% – 195%, under conservative assumptions. On the more optimistic side, we could witness a staggering 190% – 300% return.