Executive Summary

Primo-tech is a manufacturer and distributor of cleaning, paper, and nylon items. The company has recently (2023-Q4) experienced a significant increase in earnings due to the conflict in Israel, due to the Israeli Defense Forces (IDF) being its largest customer. With an equity multiple of 83% and current price to earnings ratio of 5.6, it appears that the market may be undervaluing the company. Our analysis indicates a potential upside of 15-50% in the forthcoming year.

About Primo-tech

Primo-tech is a manufacturer, importer and distributer of a wide range of cleaning products, paper products, nylon products, single-use products, cosmetics and related medical and geriatric equipment. The company distributes about 2,500 products to approximately 5,400 customers.

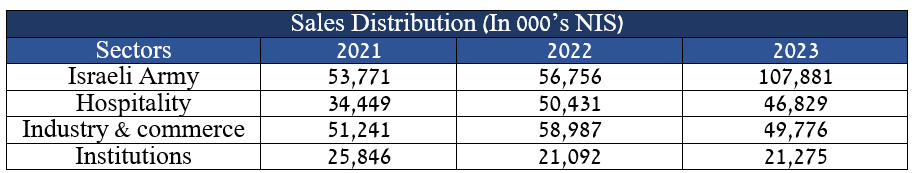

Below is the group’s sales distribution among the sectors:

Primo’s largest client is the Israeli defense forces (IDF). The spike in sales in 2023 is mainly due to the war that began in the middle east in the 4th quarter of 2023. The company finished 2023 with a profit of ~25 million NIS, 15 of which in the 4th quarter alone!

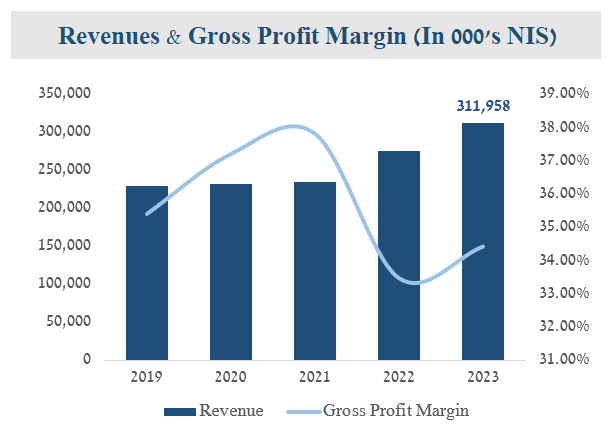

Below is a graph summarizing Primo’s sales and gross profit margins:

Competition

Despite facing intense competition, Primo-tech maintains a modest market share. Unlike its rivals who prioritize retail customers and brand recognition, Primo-tech focuses on serving institutional clients such as governmental offices, hospitals, municipalities, and hotels. Retail clients contribute to only approximately 15% of Primo-tech’s overall sales.

Management

The combined ownership stake of the chairman and chief executive officer accounts for approximately 80% of the company. This ownership stake, coupled with an effective incentive system that rewards management based on profitability targets, fosters a strong alignment of interests between the management team and minority shareholders.

Catalysts

There are three factors that are anticipated to drive value creation in the near future:

Firstly, the ongoing war in Israel has resulted in high demand for the company’s products, particularly due to the Israeli Defense Forces (IDF) being its largest customer. As long as the war persists, it is reasonable to expect that the company will achieve record-breaking revenues and profits in 2024.

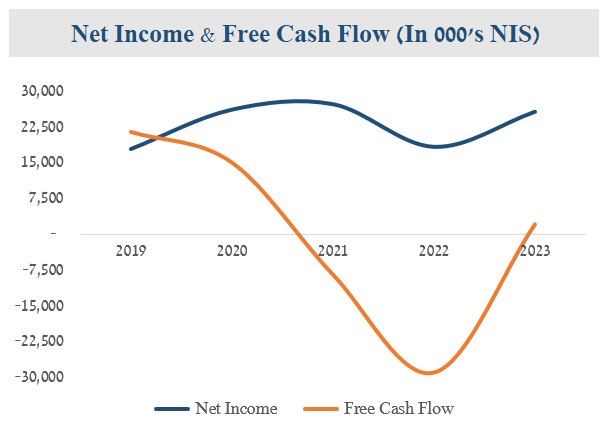

Secondly, the company has nearly completed the establishment of a new manufacturing and logistics facility, as well as new offices. These investments took a toll on the company’s ability to generate free cash flow. Since these investments are coming to an end, we can expect the company to significantly increase its capacity to generate free cash flows (see graph below, showing historical levels of profits and free cash flows).

Lastly, as of April 14th, Primo-tech is currently trading at 141.2 million NIS, with equity valued at 169.9 million NIS (equity multiple of 0.83%), and a price to earnings ratio of 5.6. In comparison, the leading company in the field, Sano, trades at an equity multiple of 2.25 and an earnings multiple of 18. While Primo-tech is not deserving a valuation on par with the industry leader, the current valuation appears to offer a satisfactory margin of safety and potential for growth if the market recognizes the disparity and potential of Primo-tech.

Considering the present favorable market conditions and the undervaluation of Primo-tech, we anticipate a potential increase of 15-50% within the next year.