About IBI

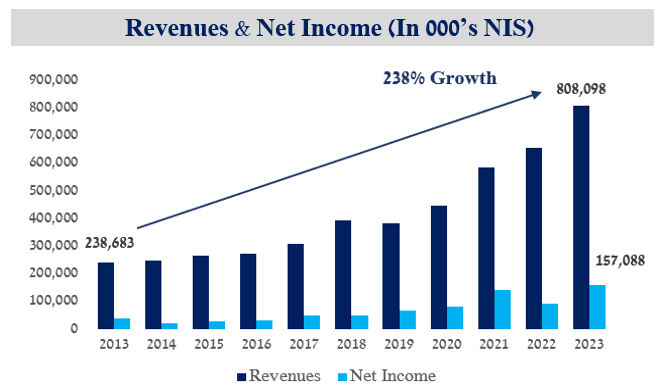

Since its establishment in 1971, IBI has become a leading investment house in Israel, offering a comprehensive suite of financial services including brokerage services, portfolio and mutual funds management, alternative investments, trust services, underwriting, and financial advisory services encompassing pensions, insurance, and mortgages loans.

Products and services

Brokerage services

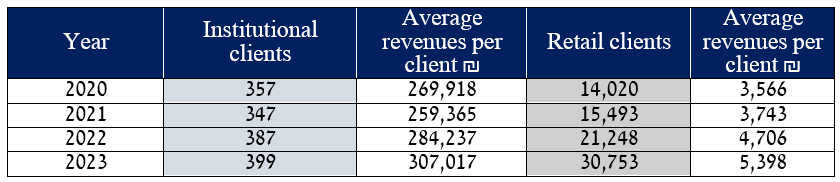

IBI provides applications to trade financial securities. As of 2023, the majority of the brokerage revenues stem from the retail clients:

Alternative investments

This particular sector encompasses the initiation and administration of alternative investments as a general partner. IBI manages alternative investment funds across diverse fields, such as credit backed by real estate in Israel and abroad, consumer credit, digital infrastructures, CLO’s (collateralized loan obligations), hedge funds, and more. IBI generates revenue in this segment through performance fees that surpass a certain hurdle rate, in addition to management fees. As of the end of 2023, their total assets under management amounted to 10.8 billion NIS, reflecting a 13% increase from the 9.5 billion in 2022.

Portfolio and mutual funds management

The mutual funds industry in Israel is at a size of 450 billion (2023). IBI manages mutual funds at an aggregate size of 17 billion. In the portfolio management segment, IBI has 35.7 billion under management, an increase of 15% from 2022.

Trust, underwriting and financial advisory services

IBI provides trust services to corporations and individuals, including services for equity rewards programs, trusts for mergers and acquisitions transactions, financial trusts in various fields such as real estate and bonds. Additionally, IBI is holding a 33% stake in an underwriting public company (IBI underwriting – value of 68.5 million NIS), as well as an insurance and financial advisory arm that oversees ~40 billion NIS.

The Market

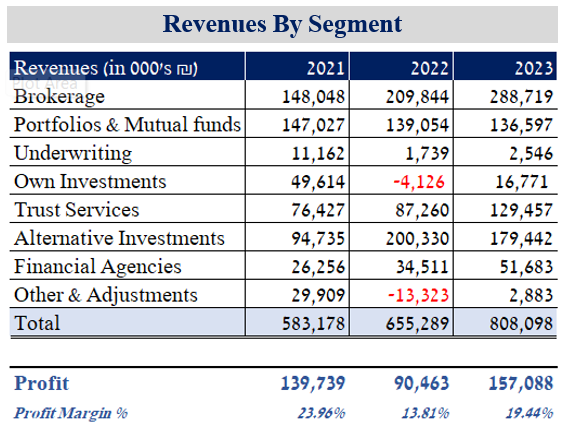

According to IBI’s latest financial reports, their estimate of their position in the market is as described below:

Recent data indicates that approximately one million individuals in Israel are using brokerage services. Despite the presence of alternative brokerage firms that offer much lower trading costs, banks still handle around 90% of trading activities. Additionally, data from the Israel Securities Authority shows that 92% of managed portfolios in Israel are managed by banks. In the underwriting sector, there are only 7-8 major underwriters in Israel, with IBI being one of them. The rest of the participants in this industry are relatively smaller entities.

Future Growth

The industries in which IBI operates are forecasted to undergo organic growth at a satisfactory pace in the years to come. In the aftermath of the Covid-19 pandemic, the stock market has experienced a surge in activity, attracting a fresh cohort of investors. Generation Z, encompassing individuals born between 1997-2012, has exhibited a heightened interest in stock market engagement and investments relative to previous generations at a similar life stage. This shift is poised to drive notable expansion within the market. Furthermore, it is predicted that the market dominance of banks in the brokerage and portfolio management sectors will diminish significantly in the forthcoming years, given the increased ease of opening brokerage accounts and transitioning between financial institutions. Needless to mention, the lower trading costs brokerage firms offer will also play a significant role in transitioning clients from banks to investment houses like IBI.

IBI are also conducting acquisitions that further increase their market share and footprint in new fields. Recently, they’ve purchased 30% of the future cash flows of a leading financial planning firm. Also, they’re negotiating a deal with a distressed investment house to purchase its index funds business (AUM of 28 billion) for 147 million NIS – which is expected to add annual revenues in a range of 40-60 million NIS. These acquisitions will diversity their revenues and further increase their services offerings.

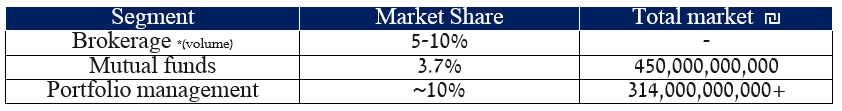

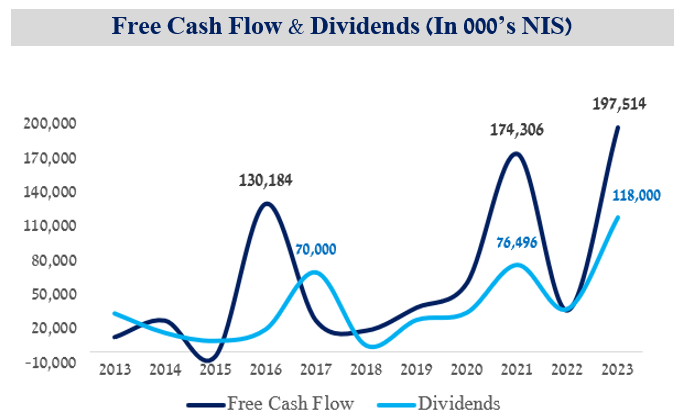

The graph below shows their historical financial performance:

Competitive position

Despite facing fierce competition, IBI has positioned itself as a leading player in the financial services industry in Israel. While its market share may be relatively modest, IBI offers a wide range of services, making it a versatile provider capable of meeting the diverse needs of different types of clients.

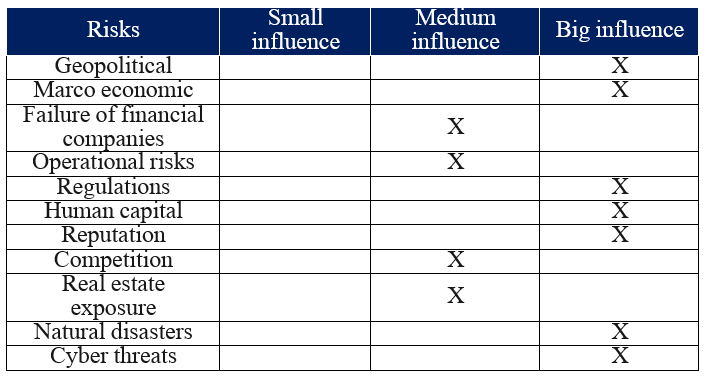

Risks

Apart from the risks mentioned above, another significant risk to a financial services company like IBI is posed by emotions of the masses. During times of economic recession, the company may face difficulties in sustaining its business activities. Conversely, in periods of high market enthusiasm, there is ample opportunity for substantial growth. Another critical risk pertains to the inability to deliver satisfactory results for clients as a result of unsuccessful investment decisions. Any involvement in scandals or the delivery of poor financial performance by the investment management arm could undermine public trust in the firm, consequently impacting its profitability and future prospects.

Human capital

In 2022, the employee count at IBI stood at 549, and each employee contributed to an average revenue and profit of approximately $332,000 and $45,000, respectively. In 2023, head count already stood at 625, with revenue and profit per employee of $359,000 and $69,500, respectively. This 50% increase in profit per employee sheds light on the strong operating leverage IBI has.

It is noteworthy that the founders and insiders maintain ownership of over 80% of the company. This is a positive indication, as it provides a significant motivation to consistently distribute dividends. Additionally, IBI has implemented an effective executive management incentive structure that rewards executives solely based on exceeding a specific profitability target. This framework enhances the alignment of interests between the management team and shareholders.

Recent developments

- IBI are currently in the process of purchasing an index funds operation that will add additional 28 billion NIS to their assets under management.

- IBI’s largest fund, the US consumer credit fund (CCF) encountered liquidity difficulties as a result of the rising interest rates that began in 2022. In response, IBI had to impose limitations on withdrawals and temporarily waive management and performance fees until the end of 2024. IBI’s estimation indicates that the total financial impact in terms of revenue and profit losses will reach up to 30 million and 6.5 million NIS, respectively. Today, the fund is down from 2.6 to 2.35 billion NIS under management, and more withdrawals are expected.

- The outbreak of a conflict in Israel on October 7th, 2023, has led to increased instability, potentially resulting in a temporary weakening of the Israeli economy. Continued hostilities may further impact the financial performance of IBI, as investor confidence in public markets and alternative investments could diminish.

- A leading financial institution has recently increased its investment in a subsidiary of IBI that operates within the reverse mortgage sector. This investment serves to increase the subsidiary’s value and creates an opportunity for a potential initial public offering down the line.

Valuation

Between 2019-2023, IBI’s average return on equity was ~18%. We expect them to be able to achieve between 8 – 15% returns on equity in the next few years. As can be seen in the graph below, IBI has a long track record of generating hefty free cash flows and distributing dividends consistently.

Nowadays, companies in the financial services sector, particularly those engaged in pension and mutual funds management, are being valued at a book value ratio of 2 and a price to earnings ratio of approximately 8. Although IBI had a book value ratio of 0.5 in 2013, it is clear that those days are now a thing of the past. The market appears to be pricing the growth potential of companies in this industry accurately, even amidst rising interest rates.

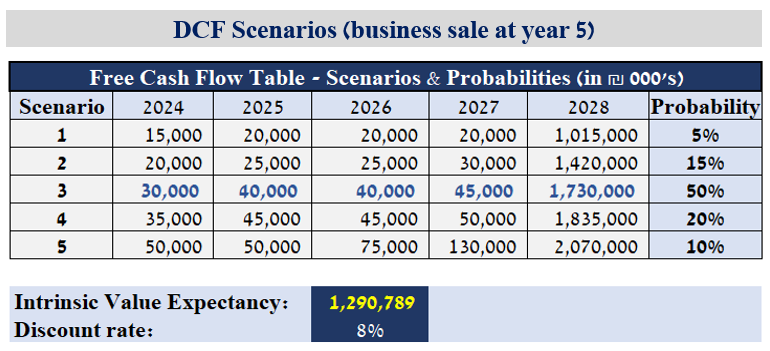

Since the future financial results of IBI could be highly volatile and unpredictable, a 5-year time horizon is appropriate for valuation. In this case, we assume the sale of the business after 5 years.

Conclusion

As of March 21st, 2024, the market valuation of IBI stands at 1.365 billion NIS. This valuation corresponds to a price to earnings ratio of 8.7 and a book value ratio of 1.98. Our analysis indicates that the intrinsic value of IBI is estimated to range between 1.2 and 1.3 billion NIS. Therefore, considering our assessment, the current market price seems to accurately reflect the fair value of the company. Despite facing intense competition and holding a relatively small market share, as well as the ongoing war and political uncertainties, we view IBI’s future long-term prospects as highly favorable.