A common saying is that there are only two things that are certain in life: Death and taxes. For this article’s purposes, we’ll add inflation too.

What is inflation, and what are its causes?

Inflation means prices are going up in an economy. It is mostly due to high demand and low supply. Central banks try to keep inflation low at 1-2%. Too much inflation can be bad for an economy, making it hard for businesses to operate effectively with prices changing constantly.

The Weimar Republic in the 1920s faced a hyper-inflation that devastated the economy and paved the way for the Nazi party’s rise to power. Similarly, Zimbabwe experienced a staggering monthly inflation rate of 79.6 billion% in 2008-2009, causing $1US to be worth 2.65 billion Zimbabwean dollars. These examples highlight the importance of protecting oneself from inflation, regardless of occupation or business size.

The best protection against inflation is…

Although gold preserves its purchasing power, it doesn’t generate any income. Likewise, real estate maintains its value, but it can be highly challenging to adjust rent prices to match the rising costs during periods of high inflation.

What’s left then?

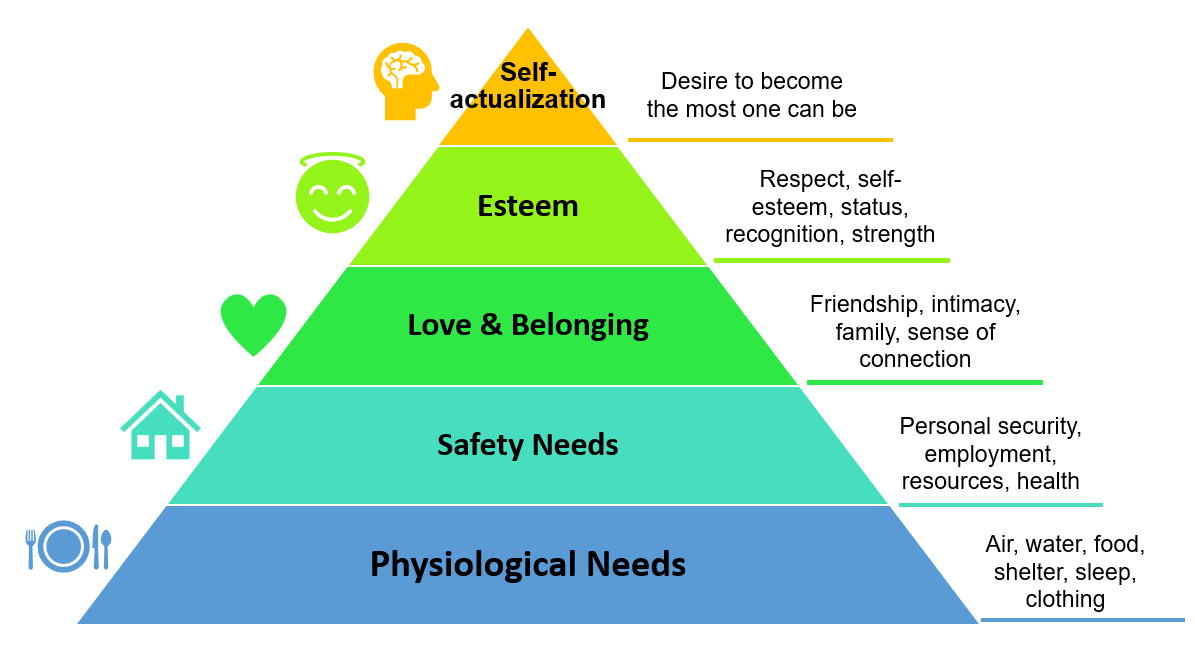

The ultimate safeguard against inflation lies in owning profitable businesses that offer products or services that are indispensable to everyone. However, what are people’s true needs? According to Maslow’s hierarchy of needs theory, humans have a strong need for food, shelter, security, sleep, and more.

Which are the perfect businesses to overcome inflation?

Predicting the success of businesses during uncertain economic times involves considering human behavior. Essential products like electricity, water, food, and Microsoft software are examples of products/services that are likely to maintain steady demand even in challenging economic conditions.

The modern world relies heavily on electricity to function properly. Without it, people would struggle to store food, work, or stay connected with the world. The absence of electricity would take us back to a time similar to the dark ages. Power plants could serve as a great businesses to safeguard against inflation.

Owning businesses that have a competitive edge and pricing power is beneficial when inflation is on the rise – which reminds me of Microsoft. The worldwide usage of Microsoft software makes it exceptional. If Microsoft were to disappear, it would be a gloomy day indeed. The importance of Microsoft will enable it to effortlessly increase prices by 500%. This creates a strong competitive advantage.

Fortress investing

I call this investment philosophy “Fortress investing”. Investing is more about protecting the downside than having wishful thinking about the future. If your thesis is right, the upside will take care of itself.