“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.

– Albert Einstein

Egypt has The Great Pyramid of Giza, China has The Great Wall, Babylon has The Hanging Gardens, Peru has Machu Picchu, and finance has Compound Interest. What’s fascinating about the 8th wonder of the world, is that while empires rise and fall, and great cities come to ruins, the mathematical principle of compounding remains.

Money today has more value than it will have tomorrow. Why? Because if you have a $1,000, you can choose to spend it today or save it for a later use. If you choose not to spend it, the money will lose its value due to inflation. For the money to maintain its purchasing power in the future, people require to earn interest on unused money. Investors aim to achieve a real return on their invested capital [above the rate of inflation].

Starting early is important

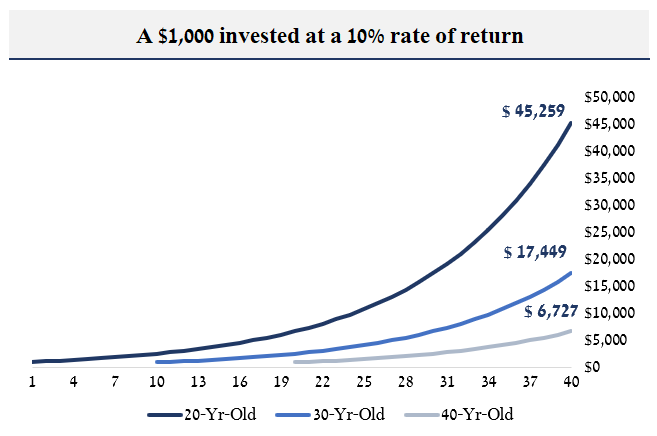

The earlier one starts investing, the better the potential outcome. Having a longer investment horizon not only enhances potential returns but also reduces the risk of permanent loss of capital. Consider this scenario: if a 20-year-old invests $1,000 and earns an average of 10% per year until the age of 60, their investment will grow to $45,259. However, if someone starts at 40 years old, after 20 years their investment will only reach $6,727. The latter is still a respectable result.

In auction driven markets where the return potential relative to risk is greater, anything can happen within a timeframe of three years. The S&P500 went down 19.4% in 2022, only to regain momentum and soar 24.2% in 2023. These price fluctuations happen all the time. But when we look at the big picture – say, from 1965 to 2023, the S&P500 recorded a 31,223% gain [including dividends], or 10.2% annually on average. When we approach investing with a long-term perspective, small bumps on the road seem insignificant.

How to approach investing

For most people, what will work the most is index-investing. After all, the S&P500 is too dumb to sell Nvidia, Google, Tesla, Microsoft and Amazon. We humans are prone to psychological misjudgments which will cause us to make the wrong decisions at the worst times. A great way to avoid such misjudgments is through index-investing.

It is worth noting that past performance of indexes does not guarantee future outcomes. In essence, stock prices are determined by the value investors place on a company’s assets and anticipated future earnings. During times of economic downturn, public equities can become severely undervalued. In such instances, companies that can withstand challenging environments and continue to distribute dividends are highly desirable.

Those who seek a more exotic journey can invest in individual companies in an undiversified way. Between 1965 and 2023, Berkshire Hathaway recorded a 4,384,748% gain, or 19.8% annually on average [yes, that’s over 4 million percent].

In Berkshire’s 2022 letter to investors, Buffett wrote:

“In 58 years of Berkshire management,

most of my capital-allocation decisions have been no better than so-so…”

“Our satisfactory results have been the product of about a dozen truly good decisions. That would be about one every five years…”

The virtue of patience

What Buffett says basically, is that roughly 12 investment decisions over a period close to 60 years are responsible for the majority of Berkshire incredible track-record. We can assume he invested in hundreds of companies over the years, so that makes it a low single-digit success rate.

The moral of the story here is that although incredible investment opportunities present themselves quite rarely, the most important thing about those investment decisions is not that Buffett bought the companies – its that he didn’t sell them. That’s the virtue of patience. For compound interest to work in our favor, we ought to focus on the long-term horizon.