Max.

simple. predictable. high returns on equity.

Max Stock is an Israeli company that deals in the discounted retail sector under the brand name “MAX”, and sells products such as housewares, consumables, office supplies and more everyday goods.

Max Stock Is The Leading Discount Retailer In Israel

Max has 59 branches across Israel and it recently launched its first store in Portugal (as of March 2023).

Max operates in two models:

- Stores under ownership

- Franchising

Max has 2 types of stores:

- Max – Big stores at an average size of 1,900 square meters

- Mini Max – small stores at an average size of 200 square meters

Products

Max sells discounted everyday goods like housewares, consumables, office/school supplies, apparel basics & more. The goods are 60% imported, while 60% of the products being non-discretionary and 70% of the products sell for 10 NIS or less (less than $3).

Store Management Model

As of December 2022, Max had 56 stores, of which 40 were the big stores and 16 were the Mini-Max stores. 32 of the 40 big stores were under ownership, and 1 out of the 16 min stores was under ownership. The franchising agreements are usually signed for periods of 4-5 years with an option to extend.

Each store under ownership is held in stakes of 70-90% and the rest belongs to the manager. This model aligns interests between Max and the manager. Each franchised branch pays 3.75% of its revenue as a commission to Max. as well as an upfront fee for the right to the brand name. The stores under ownership pay 2.5% of their revenues as fees to Max.

Competition

Discount retailing is a highly competitive business with small barriers to entry, however, branding power is highly influencing as to which stores customers will go to.

Competition in Israel is fierce, however, Max-Stock is the leader in the field with over 40% market share, although they do not have the most branches. In recent weeks, a competitor called “Jumbo Stock” announced a halt due to credit issues. This only proves how difficult this sector is, and why customers loyalty is so important.

What differentiates Max-Stock in this highly competitive environment?

The power of Max-Stock is its product variety, locations, good customer experience, pricing, but most importantly, its branding.

People recognize Max-Stock. People love Max-Stock. People know that people love Max-Stock. Because people know that people love Max-Stock, more people go to Max-Stock. It’s fun to love what everyone else loves. That’s the power of branding.

All the competitors in the field sell similar products. What matters is how the company engages the customers.

Marketing Strategy

Max has a strong online presence in social media. Max focuses a lot on social media in order to engage with customers. Here are some numbers:

Facebook: 333k followers

Website: 2.2m entries in the 12 months ending 2022

Instagram: 200k followers

Tiktok: 14.5k followers

Max is by far has the most influence on social media which adds to its competitive edge.

Financials

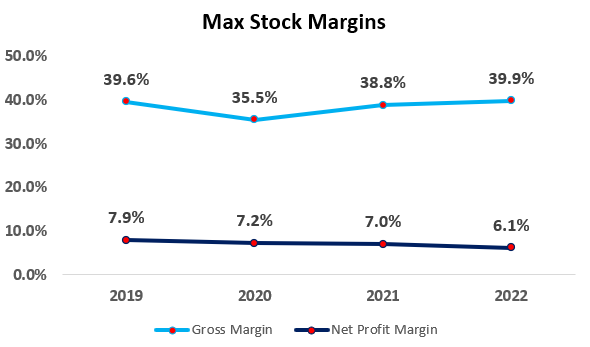

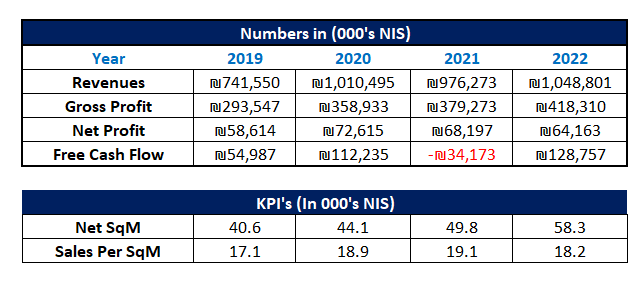

Although Max is dealing in a discount retail sector with supposedly low margins due to low pricing, Max Stock is able to achieve consistent above 35% gross margin and 6-7% net margin.

In 2020, due to the covid-19 pandemic, max began selling covid protective equipment which added 125Million NIS to its revenues in 2020. If we exclude those one time revenues, 2020 should’ve had 885 Million in revenues and it would’ve looked like revenue grew each and every year, like they actually did.

As can be seen in the table above, Max are able to generate high free cash flow yield thanks to the fact that it takes them 20 days on average to collect payments and above 60 days to pay suppliers. Additionally, we can see that sales per SqM are growing and are at an impressive level.

Future Growth

Max’s plan is to open 3-5 new stores each year. In 2023, they also expanded into Portugal, which is a new growth engine in itself. The brand in Portugal is called Max-10 and the concept is to sell products under 10 euro a piece.

Max’s goal is to reach 80k square meters of commercial space by the end of 2025, which under an assumption of 18k NIS of sales per square meter, takes us to 1.44 Billion NIS in revenue, up 37% from 2022. Growth engines are basically opening new stores and increasing sales per SqM. It is possible to grow sales per SqM by simply selling more expensive products, which max are already doing.

Assuming 7% profit margin on 1.44 Billion of sales, net profit would reach 100 Million.

Management

My evaluation of the management is that they are competent and will be able to execute on their plans. Max Stock is operating as a family business, as many of the founder’s friends and family are involved in the business. Additionally, the founder has skin the game, which is important.

Some of the stores are leased to the company by the founder of the company, which has pros and cons. For example, if there is an emergency, the founder could be understanding regarding the lease rates or payment arrangements.

The founder and CEO, Mr.Ori Max has decades of experience running retail stores. He is passionate, dedicated, and I believe that he will continue to push the company to new highs.

Valuation

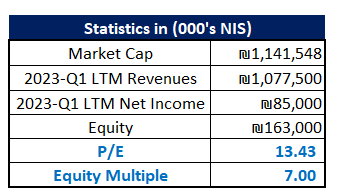

Currently, I can’t say that Max are trading cheaply. After all, their equity multiple is 7x, however, their ROE (return on equity) is in the high double digits (above 50%), and is expected to be so in the near future.

Given that they will keep opening more stores in the coming years, revenues and net income will increase and they will keep generating high free cash flow yield, I would say that the current market capitalization of 1.15Billion NIS is a fair price, as Max could be trading at 1.5 – 1.7Billion in the next 3-4 years. It is also likely that the market capitalization won’t grow as much, if the company will distribute a lot of dividends as they did in the past.

That does not sound like a very sexy investment, however, given the high ROE, Max being the market leader in the field with much more room to grow, it suits my investments objectives.

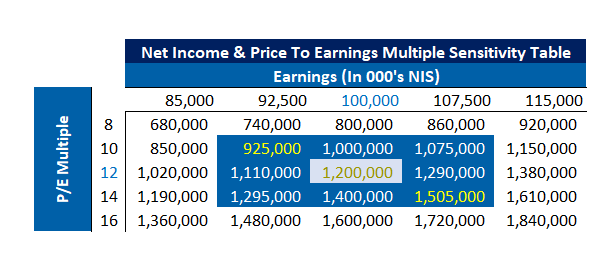

Below is a sensitivity table to summarize what the valuation of the company might look like in 3-5 years: