Israel, also referred to as the start-up nation, has experienced remarkable economic growth in recent decades. Despite being a relatively young country, only 74 years old, and facing challenges from neighboring enemy countries and engaging in multiple wars since its establishment, Israel has achieved impressive progress.

Here are 3 reasons why Israel is an attractive market for investors:

1) Low Liquidity

Large money managers may find it challenging, but for individual investors or small fund managers, low liquidity can be advantageous. It creates opportunities for value investors due to the potential mispricing of stocks. This makes it an ideal market for those seeking value investments.

2) Innovation

Israel, a country that emerged in 1948, has faced constant challenges to its existence. Just three years after the Holocaust and World War II, a coalition of Arab nations invaded the newly formed state with the intention of destroying it. Since then, Israel has been in conflict with Arab nations, although a few peace treaties have been achieved. The ongoing existential threat to Israel, posed by Iran, Lebanon, Hamas, Syria, and other hostile nations, necessitates a strong and superior military. The Israeli Defense Forces (IDF) are constantly driven to develop innovative and creative strategies to counter these threats, and they must act swiftly.

The IDF mandates that youth in Israel must undergo military service starting at 18 years old, lasting for about two and a half years. Within this timeframe, young soldiers acquire valuable skills in leadership, teamwork, and the utilization of cutting-edge technology. Undoubtedly, he IDF serves as a breeding ground for talent.

After completing their military service, these talented individuals in Israel join the workforce and use their unique skills to contribute to the economy. Ultimately, the existential threat on Israel has resulted in it becoming the most prosperous country in the Middle East, excelling in economic growth, innovation, technology, and military power.

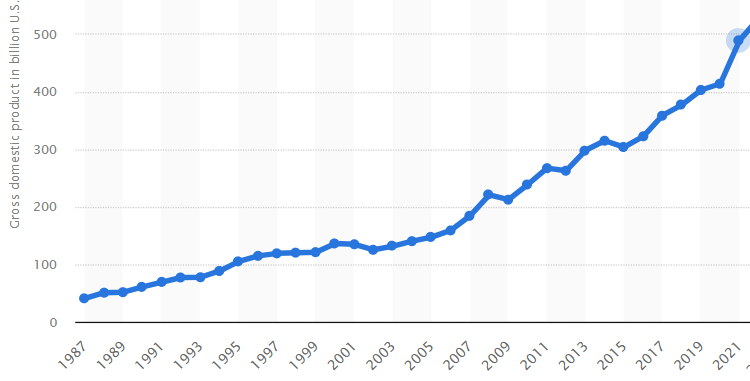

3) Economic Growth & Diversification

Despite being only 74 years old, Israel has achieved remarkable economic growth, particularly in comparison to its hostile neighboring nations. Additionally, Israel stands out for its higher birth rate compared to other western countries, and there are still many Jewish individuals living abroad who have not yet relocated to Israel. We slowly begin to see that antisemitism is on the rise again, and that is a leading driver for Jewish people from around the world to move to Israel, the only Jewish state.

The population of Israel is expected to continue growing significantly, driven by the factors mentioned earlier. Furthermore, investments in Israel will also increase as Jewish individuals arriving from other countries will bring their money with them. Moreover, the discovery of several large natural gas reservoirs in Israel’s territorial waters will provide an additional boost to the economy in the years ahead.

Israel’s GDP (Figures in $US Millions)

Picture Taken From statista.com

Image by Eduardo Castro from Pixabay